Having something to look forward to in the future is always an exciting feeling. Whether it be a car, a holiday, or house, it’s important to have a savings plan to reach your goal. For many, these exciting ambitions can seem like impossible objectives.

Swoosh have compiled a few great tips to get you started on your saving journey!

Here is our six-step plan to help you start saving for your short and long term goals today

Step 1 – Assess your current position

Start by writing down a full list of your income and expenses

Income

This includes your EXPECTED sources of income. Don’t include things like lottery winnings, no matter how confident you are! Income can come from the following sources:

- wages

- dividends from interest

- royalties

- rental income

- earnings from a business

Expenses

Regular expenses

- Rent/Mortgage

- Groceries

- Fuel

- Loan repayments

- Subscriptions (netflix, gym)

- Entertainment

Annual or quarterly

- Utility bills

- Insurance

- Vehicle registration and maintenance

Breaking quarterly expenses into a weekly cost can help you put aside money for to pay them when they are due.

Step 2 – Set your goals

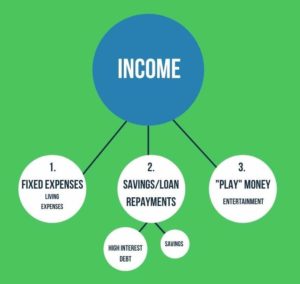

Now that know where you are financially, you can figure out where you want to go. Your goals may include paying down debt, saving for the future, building an emergency fund or saving for a specific item. Once you set your goals you can create a budget that will help you systematically work towards them. A good tip for budgeting is to prioritise your expenses. Fixed expenses such as rent and food come first, then savings/debt repayments, then variable expenses such as entertainment.

Step 3 – Pay off debt as soon as possible

Hands-down the easiest way to save money is to pay down your debt as quickly as possible. You should focus first on high interest debt such as credit cards and personal loans.

Although there might be a temptation to save money at the same time, by focusing all of your money into paying debts first, you will save money in the long run.

Money owed on things like high interest credit cards can amass very quickly, and the interest you are paying is likely to be more than you will make from the stock market or high interest bank accounts. Over time this increasing debt has the power to eat back into your savings, or see you spiral into greater debt.

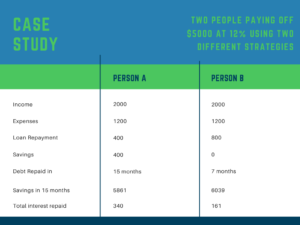

To illustrate the point we are going to compare two people paying off a debt and saving money. In this case study we will look at 2 people repaying a $5000 debt at 12%pa. Person A repays the minimum $400 per month and saves $400 per month. Person B pays $800 per month until the loan is paid and then saves once it is paid off

As you can see Person B is ahead by almost $200 by the end. Both people have the same income and expenses, the only change is how they are paying off their debt.

This isn’t to say that paying off debt should always take precedent. Putting away money for an emergency fund is a great idea – just put the largest chunk of your money after expenses towards paying off high interest debt.

Step 4 – Split your savings

Now that you have set your goals, paid off your debt and are saving money you are ready for our next tip!

You should always have two or more separate accounts for savings. One for short-term goals like a holiday or other luxury items and another for long-term savings. The idea is not to touch the long-term savings until you have reached your goal. This may be buying a house, saving for retirement or an investment opportunity. Either way, the long-term savings account is not for that new jacket or motorbike.

You may choose to have one or two other savings accounts. One can be used for necessities such as utility bills and car registration or other essentials that pop up on a not-so-regular basis. The other can be for things you want to splurge on but don’t need – like a holiday or new toy.

By structuring your savings this way you fulfil three basic financial needs – security for the future, having money for bills when you need it and being able to treat yourself.

Step 5 – Automate your Savings

This one is simple. By prioritising your savings you can change your habits and foster a savings mentality.

Setting up withdrawals to automatically come out of your account works effectively for saving in a variety of ways. Firstly, money is taken out of your account and placed into a high interest savings account to accrue interest. More money in these types of accounts means more interest.

The second advantage is more of a lifestyle change, which has the power to transform temporary habits into long term behaviour. Because having money transferred out of your spending account leaves you with less money to actively use every pay-cheque, an adjustment must be made to how money is spent every month. This ultimately leads to new spending habits that can last long into the future, with even more potential for money saved in the long term.

Step 6 – Stick to the plan!

This is the hardest and most important part! The key to success is to leave some wiggle room in your budget each week. After all, life is for living, so make sure you allocate a little bit of money each week to treat yourself.

This blog post has some great tips on how to curb impulse spending.

BONUS TIP: Get a piggy bank for loose change

Although it may seem like an outdated or childish thing to do, having a piggy bank in your home is a very underrated way to save money.

Every time you might have loose change in your wallet, it’s a great idea to drop it into your piggy bank (you don’t have to buy an actual big shaped moneybox any container will do!). This can be a highly effective saving method because the loose change is rarely missed but has the power to add up significantly over time – even just $2 a day can add up to over $700 a year.

Once you think your piggy bank starts getting heavy from all the change you’ve been regularly depositing, take it into your bank branch and put it directly into your savings. This works excellently as a monthly routine, getting you into the habit of making your new piggy bank work for you.

Almost reached your goal?

If you’ve been saving for a while and are just within reach of your goal, Swoosh can offer the help you need. We know you have the power to save, which is why our fixed term loans are perfect for people who need that little bit extra to play around with. Scheduled repayments make things even easier – contact us today to learn more.